- Following the BOJ’s December policy action, moves to increase YCC flexibility turn more likely

- Chances for the BOJ to hike rates or abandon YCC remain relatively low

- A stronger China recovery, oil rebound, BOJ governor change, and political uncertainties pose risks

- JGB curve will likely steepen further in 1H; 10Y JGB yield could head a tad above 0.6%

- JPY could recover from its record under-valuation as the BOJ allows more flexibility in YCC

Related insights

- Eurozone rates: Hat-trick of rate cuts 18 Oct 2024

- USD Rates: Fight the Fed, not the data18 Oct 2024

- Research Library18 Oct 2024

BOJ: Policy tweak or tightening?

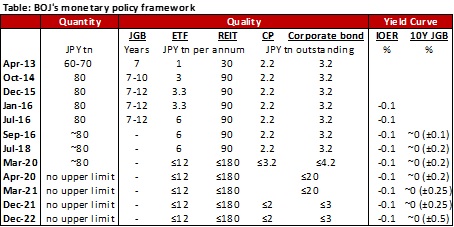

The Bank of Japan surprised the markets by widening the 10Y JGB yield band from ±0.25% to ±0.5% at the December 20th meeting. The governor and board members both emphasized that the move was not intended to tighten monetary policy. They cited the need to improve bond market functioning amid the increase in overseas market volatility, and to enhance the sustainability of monetary easing under the Yield Curve Control (YCC) framework.

But investors speculate a policy pivot is in the works. The magnitude of yield band widening is bigger than that during July 2018 (±0.1% -> ±0.2%) and March 2021 (±0.2% -> ±0.25%). The ceiling of 10Y JGB yield has now been lifted to 0.5%, which means that 10Y yield could revisit the levels in 2014-2015 – after the QQE was established in 2013 but before the YCC was introduced in 2016.

We discussed the possibility of yield band widening during an earlier publication in September 2022 (see here). Following BOJ’s December policy action, we think other moves to increase the YCC flexibility become increasingly likely in 2023. These include further widening the 10Y yield band to ±0.75% from ±0.5% and shifting the 0% target to 5Y from 10Y JGB yield. Such a move could come at any of the next four policy meetings in 1H23 (mostly likely in April). The BOJ’s holdings of JGBs have exceeded 50% of the outstanding total amount, which has weakened bond market functions and created operational issues. Challenges could remain in the near term, given the increase in investor expectations about BOJ policy normalisation and renewed selling pressure in the JGB market. These will likely ease towards the middle of this year, as the Fed and other major global central banks will pause tightening by then and global yield pressure will generally abate.

Chances of BOJ rate hikes in 2023 are still relatively low. These refer to an increase in the policy balance rate from -0.1% to 0% (i.e., ending of the negative interest rate policy), and an increase in the 10Y yield target from 0% to 0.25%. Such tightening measures will require a meaningful improvement in Japan’s growth and inflation outlook. GDP figures continued to disappoint recently, reporting a modest contraction of -0.8% QoQ saar in 3Q22. Industrial production has started to contract sharply on the sequential basis since September, due to the deterioration in external demand conditions and the increase in destocking pressure. Even assuming a strong above-trend growth in services output on the back of border reopening, we infer that GDP growth will be just about 1% this year. This means that aggregate output will only return to the pre-pandemic normal levels and output gap will only be closed by the end of 2023.

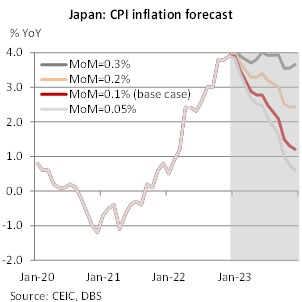

CPI inflation rose faster than expected in recent months, hitting 3.8% YoY in November 2022. The current momentum suggests that CPI numbers could rise further to hit 4% in January. But pressure will likely retreat from February onwards, thanks to the pullback in oil prices, a more stable yen exchange rate, as well as the higher base effects. Under the base case scenario, we expect CPI inflation to ease below 3% by 2Q23 and below 2% by 4Q23. This assumes that the MoM CPI change is around 0.1%, higher than the long-term average of 0.05% but lower than last year’s 0.3%.

Given the tepid growth outlook and peaking inflation, we maintain our forecasts for the BOJ to keep the policy balance rate and 10Y yield target unchanged at -0.1% and 0% respectively through this year. Risks could come from a faster-than-expected recovery in the Chinese economy and strong rebound in oil prices. Japan’s inflation could remain above 2% for a protracted period, while GDP growth could prove to be more resilient than expected. Should these upside risks materialise, the BOJ would consider a modest rate hike at some point in the second half of this year.

Chances are also low for the BOJ to abandon the YCC in 2023. To abandon the YCC and allow interest rates to be largely determined by market forces, the BOJ will need to ensure a self-sustained economic recovery in the longer term, driven by positive wage-prices dynamics. In this regard, the latest 4Q22 Tankan survey showed that inflation expectations among Japanese enterprises have risen further to 2.7% for the next one year. The expected inflation rates for the next three and five years have also risen above 2%, to 2.2% and 2.0% respectively.

That said, the momentum of wage growth remains insufficient. Growth of total nominal wages in all industries remained a tad lower than 2% YoY as of October 2022. Growth of base wages, which excludes bonus and other one-time components, continued to advance at the 1% rate. Given the increase in public inflation expectations and a weak yen that boosts corporate profits, we think wage growth will pick up further after the next around annual labor negotiations in March-April. But it remains doubtful whether wage growth could rise sufficiently to 3%, an ideal level seen by the BOJ to achieve a stable 2% inflation target and growth in real consumer spending.

In midst of lack of convincing evidence about a self-sustained recovery, we think the BOJ will not rush to abandon the YCC framework this year. Risks could come from the BOJ governor replacement and a possible change in the country’s top leadership. It currently remains unclear whom PM Kishida will appoint as the next BOJ governor after Kuroda retires in March. It also becomes unclear whether Kishida will stay in office till his term as LDP president ends in September 2024 (his approval rating fell to ~30% recently). These non-economic factors pose some uncertainties for the continuity of the YCC policy framework this and next year.

JPY to strengthen amid wider JGB yield band

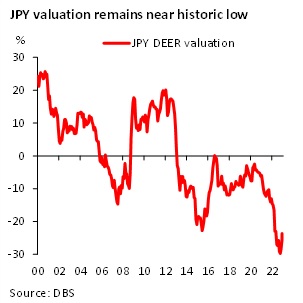

Beyond improving bond market functioning, we believe a widening of the 10Y JGB yield band will support a JPY recovery amid historically low valuations, as indicated by our long-term DBS Equilibrium Exchange Rate (DEER) models. ]

]

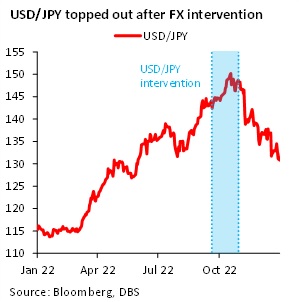

Japan had previously sought to arrest JPY declines via unilateral market interventions starting in late September. But such interventions lead to a contraction in the monetary base, and goes against the BOJ’s expansionary bond purchases, which had increased amid a surge in JGB yields. This brings into question the coherence and sustainability of Japan’s policy settings.

To resolve such a policy conundrum of supporting the JPY while keeping rates unchanged, one policy option is to allow for higher volatility in long-term rates. Indeed, our currency research (see Impact on currencies from high rates and inflation, 22 Nov 22) showed that exchange rates typically respond positively to a rise in the volatility of domestic rates relative to foreign rates. While the official JGB 10Y yield target stays unchanged at 0%, the wider JGB trading band now and a correspondent rise in both the 10Y yield and its volatility should support the JPY and reduce policy tensions.

Of course, while the BOJ maintains that it does not view conditions for policy normalization to be in place yet, the fact remains that both inflation and uncertainty around inflation have risen. Thus, its current policy of keeping JGB yields steady within a tight range could see further tweaks, if Japan’s inflation outcomes are distributed across a wider range compared to the past. This is because investors demand higher compensation for higher inflation uncertainty. Keeping long term rates unchanged will simply prompt further JPY outflows and looks unlikely to be sustainable.

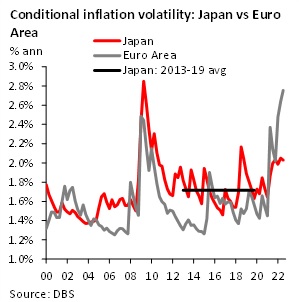

One way to assess inflation volatility is to derive conditional volatilities based on a GARCH model, with adjustments for the one-off impact of Japan’s 2014 consumption tax hike. Our GARCH model estimate indicates that Japan’s quarterly inflation volatility has stayed consistently higher than the average from 2013 to 2019—the start of Abenomics to just before the Covid outbreak.

A similar economy which has seen a surprise post-Covid rise in inflation volatility is the Euro Area. Like Japan, the Euro Area was widely expected to face long-term disinflation headwinds stemming from its aging demographics, sluggish potential growth, and elevated sovereign debt burdens. Yet the ECB is now forced to hike rates by 250bps for this cycle as it grapples with “inflation that came about from nowhere”, in the words of ECB President Lagarde. The risk is that higher volatility surrounding inflation in the post-Covid world may also lead to the BOJ considering an earlier normalization. Certainly, being more flexible in its control of the 10Y JGB yield looks more ideal amid greater uncertainty.

If the BOJ opts to further widen its 10Y JGB trading band to ±0.75% in April, we could see another bout of JPY strength, with USD/JPY likely to ease further towards 125.

Rates: Steepening pressures

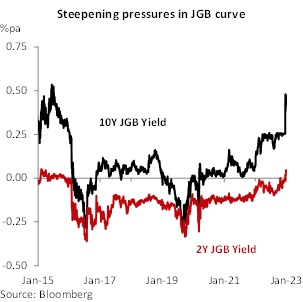

The Bank of Japan (BOJ) left it late in the global tightening cycle, finally allowing 10Y JGB yields to shift above 0.25%. Based on CPI readings over the past few months, the BOJ should have adjusted earlier. However, after the failed attempt to short JGBs in mid-2022, speculators have generally kept away until December. We think that the JGB curve will steepen further in 1H if the BOJ widens YCC by another 25bps in 2Q (we expect the move in April). Note that the mid-point of the trading band should still be at zero. With 0.75% as the cap, we think there is room for 10Y JGB yield to head a tad above 0.6%.

Current actions from the BOJ, which include consecutive days of unscheduled bond buying, might appear to contradict its underlying monetary policy stance. We think that the BOJ is in a tightening cycle but is acting to curb excessive moves in JGBs. It is also providing investors a chance to exit (by providing liquidity) their long JGB positions, if they so wish to. In some ways, the BOJ’s bond buying might be compared to what the BOE did (unlimited bond buying for a limited period) when heightened fiscal worries led to a disorderly selloff in Gilts. Note that the BOE maintained its hawkish stance after Gilt volatility subsided.

Implied 10Y real yields, at -0.42%, is smack at the median over the past eight years. Note that while the Tankan survey indicated inflation worries, particularly that 5Y and 10Y breakevens have been sideways since 2Q22. Breakevens, while high, have not convincingly crossed 1%, or approached the highs seen in 2014 (peak of 1.38%). We think that real rates/ yields will likely head higher in the coming few months as conditions remain ripe for BOJ to catch up on tightening. This will broadly mirror what other DM rates exhibited in 2022. The key difference is that tightening in by the BOJ should lead to steeper a JPY rates curve, in contrast to flatter curves when conventional short term rate hikes (other DMs) are used. We would also note that a steepening JGB curve would apply steepening pressures on other DM curves.

To read the full report, click here to Download the PDF.

Topic

Explore more

E & S FlashRelated insights

- Eurozone rates: Hat-trick of rate cuts 18 Oct 2024

- USD Rates: Fight the Fed, not the data18 Oct 2024

- Research Library18 Oct 2024

Related insights

- Eurozone rates: Hat-trick of rate cuts 18 Oct 2024

- USD Rates: Fight the Fed, not the data18 Oct 2024

- Research Library18 Oct 2024