Related insights

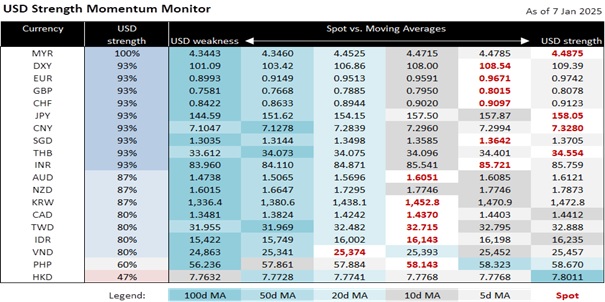

The DXY Index rebounded by 0.4% to 108.69 after two days of selling. US data surprises dampened Fed cut expectations, sending the US Treasury 10Y yield higher a third day by 5.5 bps to 4.685%, its highest level since April 2024. US JOLTS job openings increased a second month to 8098k in November, defying expectations for a decline to 7740k from October’s 7839k (revised up from 7744k). However, the ISM Services employment index met expectations with a moderation to 51.4 in December from 51.5 in November.

Unless today’s ADP employment and initial jobless claims surprises, expectations should remain for Friday’s nonfarm payrolls to slow to 163k jobs in December from 227k a month earlier. Even so, investors were spooked by inflation worries, driven by the ISM Services prices paid index rising above 60 for the first time since January. The S&P 500 Index plunged by 1.1% to 5909, while the Nasdaq Composite Index shed 1.9% to 19490. Today’s FOMC minutes will be a reminder of the Fed’s cautious approach to rate cuts this year.

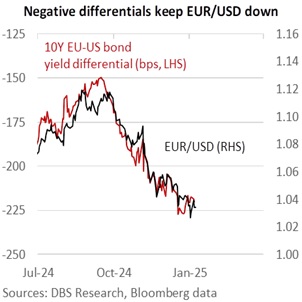

EUR/USD depreciated 0.5% overnight to 1.0340 after failing to push above 1.04 on Monday and Tuesday. While interest rate futures do not see the Fed cutting rates in the first quarter, the OIS market has priced in a cumulative 75 bps of cuts over the European Central Bank’s first three meetings this year. This divergent policy outlook was best reflected in the worsening negative yield differential between the EU and US 10Y bonds to 220 bps from 150 bps over the past four months. Although the EU 10Y bond yield did not buck rising US yields, it remained low at 2.48% amid new worries for the UST 10Y yield to push above April’s 2024 high of 4.704% towards the 5% level seen in October 2023. Unlike Trump’s first year in 2017, when the Eurozone’s growth rebounded to 2.8% from 1.8%, growth is likely to stay low at 1% in 2025 vs. a projected 0.8% last year. Not surprisingly, there is now more urgency for EU reforms amid mounting geopolitical pressures (US unpredictability under Trump, Russia-Ukraine war, China’s competitive exports), economic challenges (green transition costs, fiscal fragmentation, lagging competitiveness), and internal political strains (populism, migration, demographic shifts, the rise of far-right political parties).

US President-elect Donald Trump’s news conference yesterday was a wake-up call, countering Monday’s unfounded optimism that his tariff policies will be more measured than initially feared. Trump expressed intentions to acquire Greenland from Denmark and regain control of the Panama Canal for national security reasons and proposed renaming the Gulf of Mexico to the Gulf of America. He reiterated his idea of Canada becoming the 51st US state and his threat to impose tariffs on Canada and Mexico. Trump warned that all hell would break loose in the Middle East if Hamas did not release Israeli hostages in Gaza by his inauguration on January 20. He pledged to reverse the current offshore drilling ban to boost domestic energy production. Overall, Trump’s statements implied a more assertive foreign policy agenda, significant shifts in trade relations, and a focus on energy independence aligned with his America First agenda.

Quote of the Day

“Don't watch the clock; do what it does. Keep going.”

Sam Levenson

January 8 in history

Sophie Germain became the first woman to win a prize from the Paris Academy of Sciences for her paper on elasticity in 1816.

Topic

GENERAL DISCLOSURE/ DISCLAIMER (For Macroeconomics, Currencies, Interest Rates)

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

[#for Distribution in Singapore] This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the report is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, DBS Bank Ltd accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 11th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.