Related insights

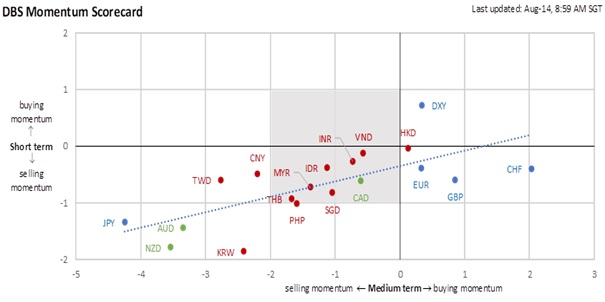

DXY appreciated 0.8% to 102.84, its highest weekly close since 30 June. Unlike the first week of July, the USD was resilient to a larger-than-expected drop in US nonfarm payrolls and a smaller-than-expected rise in CPI inflation (the first YoY increase in 13 months). On 16 August, the FOMC minutes could lift the greenback if Fed officials see another hike in one of the remaining three meetings of the year. Although interest rate futures believed the Fed delivered its final hike in July, the US Treasury 2Y yield firmed to 4.89%, its highest level since 1 August. The Atlanta Fed GDPNow model sees US GDP growth rebounding to 4.1% QoQ saar in 3Q23 after rising to 2.4% in 2Q23 from 2% in 1Q23. At the last FOMC meeting, Fed staff stopped forecasting a US recession.

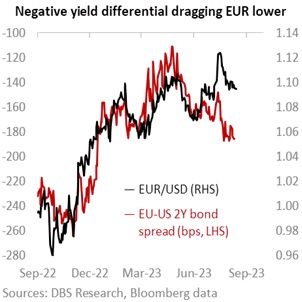

EUR/USD depreciated 0.5% to 1.0949, its first weekly close below 1.10 since 7 July. EUR will eye its mid-year low around 1.0835 if its breaks below 1.0930, its 100-day-moving average. Unlike the Fed, the European Central Bank warned that the outlook for the Eurozone economy has deteriorated. Markets do not rule out ECB pausing hikes and downgrading its economic forecast at the governing council on 14 September. The prime ministers of Italy and Portugal, countries facing recession risks, have criticized the ECB for repeated rate hikes. The ECB’s bank lending survey noted the substantial falls in credit demand for companies and households from banks further tightening lending criteria on higher borrowing costs amid stagnant growth.

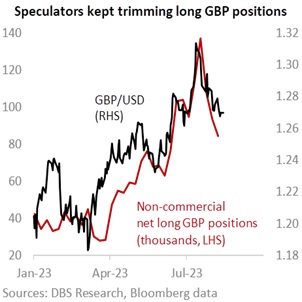

GBP/USD depreciated a fourth week by 0.4% to 1.2696, its weakest weekly close since 9 June. According to the Commodity Futures Trading Commission (CFTC), net long non-commercial GBP positions peaked at 66k contracts in the 18 July week, around which UK’s CPI inflation fell to 0.1% MoM in June from 0.7% in May. Over the next three weeks, speculators trimmed their net long positions to 46k. Pay attention to the CPI data on 16 August. Bloomberg consensus sees CPI inflation falling by 0.5% MoM in July, its first decline since January. In YoY terms, headline inflation is expected to drop to 6.8% in July from 7.9% and core inflation to 6.8% from 6.9%. On the same day, consensus sees RPI inflation falling to 9% YoY in July, its first single-digit print since March 2022. Although UK GDP growth was 0.2% QoQ sa in 2Q23 vs 0.1% the previous quarter, the National Institute of Economic and Social Research (NIESR) forecasted an economic recession in 2024 with GDP growth turning negative as early as end-2023.

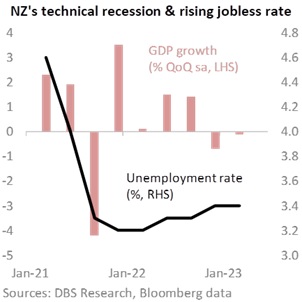

NZD/USD depreciated 1.8% to 0.5984, its worst weekly close below 0.60 since early November. On 16 August, the Reserve Bank of New Zealand should keep its official cash rate unchanged at 5.50% for a third meeting. The central bank believes keeping interest rates restrictive at current levels will bring inflation back to the 1-3% target. RBNZ sees the 525 bps of hikes since October 2021 passing through to households moving off fixed mortgage rates. The NZ economy entered a technical recession in 1Q23, with the seasonally adjusted unemployment rate rising to 3.6% in 2Q23 from 3.4% in the previous quarter. Due to the cost-of-living crisis, the ruling Labour Party is trailing behind the opposition National Party ahead of the general elections scheduled on 14 October.

Quote of the day

“Either write something worth reading or do something worth writing.”

Benjamin Franklin

14 August in history

France became the first country to introduce motor vehicle registration in 1893.

Topic

GENERAL DISCLOSURE/ DISCLAIMER (For Macroeconomics, Currencies, Interest Rates)

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

[#for Distribution in Singapore] This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the report is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, DBS Bank Ltd accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 11th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.